Hey there! I wanted to share some information about the W-4 form, which is an important document when it comes to your taxes. It’s essential to understand how to fill it out correctly to ensure that your tax withholding is accurate. So, let’s dive into it!

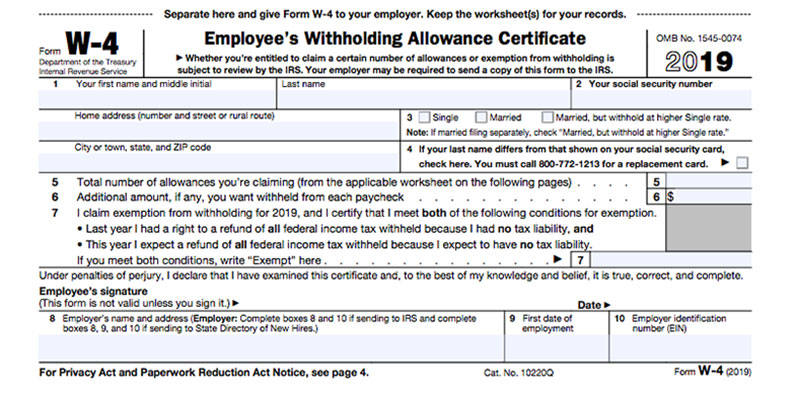

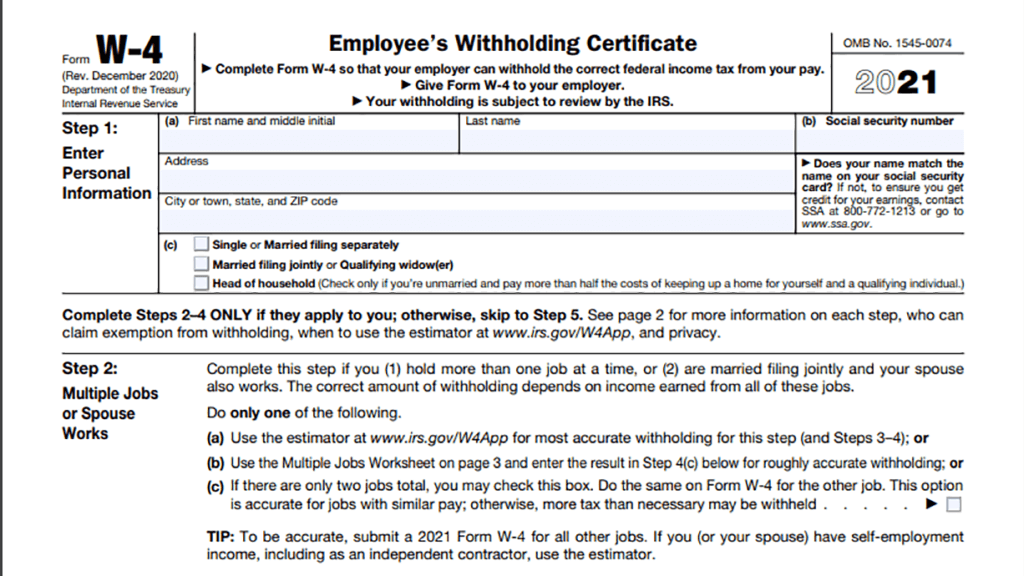

W4 Form 2021

The W4 Form for the year 2021 is an important document that enables your employer to withhold the correct amount of federal income taxes from your paycheck. It helps you avoid any surprises when it’s time to file your tax return. Make sure to provide accurate information, including your filing status, dependents, and additional income. By doing so, you can ensure that the right amount of taxes is withheld and you won’t owe a large sum or receive a hefty refund later on.

The W4 Form for the year 2021 is an important document that enables your employer to withhold the correct amount of federal income taxes from your paycheck. It helps you avoid any surprises when it’s time to file your tax return. Make sure to provide accurate information, including your filing status, dependents, and additional income. By doing so, you can ensure that the right amount of taxes is withheld and you won’t owe a large sum or receive a hefty refund later on.

W4 Form in Spanish - 2022 Version

Good news for Spanish speakers! The 2022 version of the W4 form is also available in Spanish. This makes it more convenient for non-English speakers to understand and fill out the form accurately. It’s crucial to note that the form’s purpose remains the same, regardless of the language it is presented in. So, if you prefer to complete the form in Spanish, make sure to obtain the correct version to ensure accurate information.

Good news for Spanish speakers! The 2022 version of the W4 form is also available in Spanish. This makes it more convenient for non-English speakers to understand and fill out the form accurately. It’s crucial to note that the form’s purpose remains the same, regardless of the language it is presented in. So, if you prefer to complete the form in Spanish, make sure to obtain the correct version to ensure accurate information.

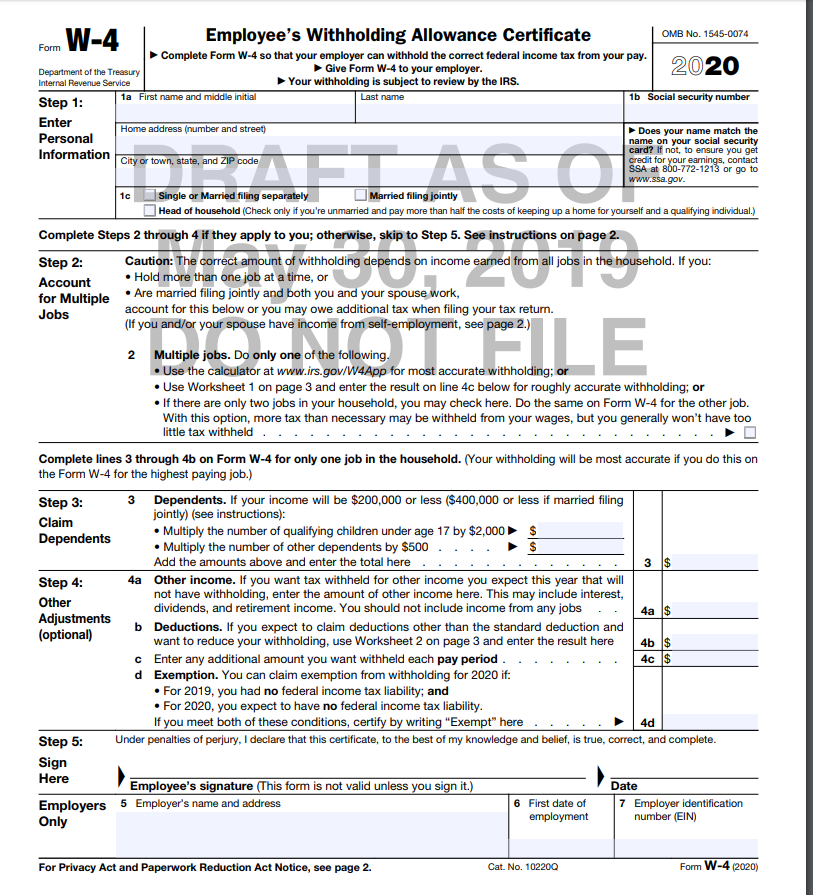

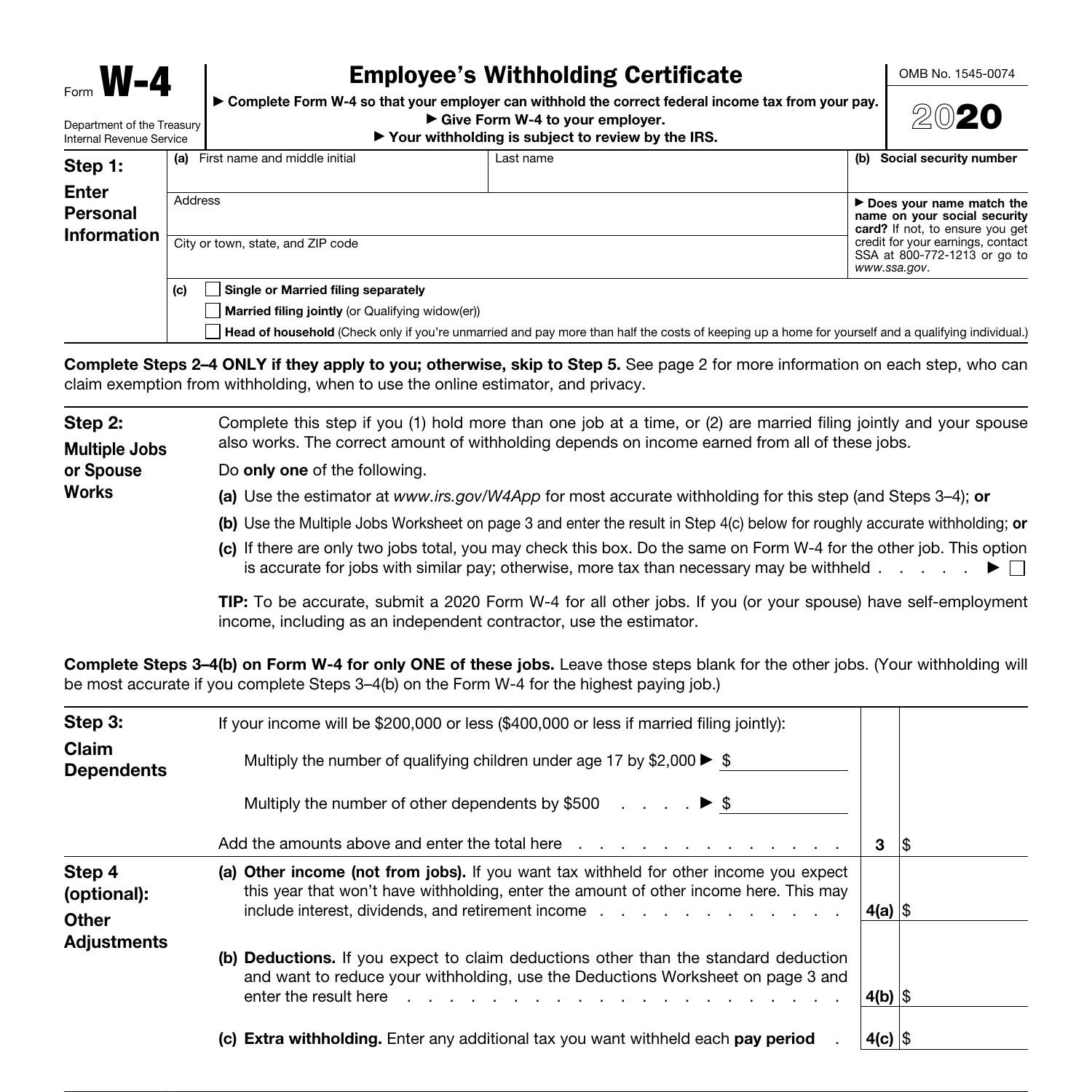

W-4 2020 Form Printable

If you still need to refer to the W-4 form from 2020 for any reason, it’s great to know that you can find printable versions available online. Keeping a copy of the older form can be helpful when comparing it to the updated versions and understanding any changes that may have occurred over the years. Make sure to note any modifications if you’ve changed jobs since 2020 or if there have been any significant changes in your financial situation.

If you still need to refer to the W-4 form from 2020 for any reason, it’s great to know that you can find printable versions available online. Keeping a copy of the older form can be helpful when comparing it to the updated versions and understanding any changes that may have occurred over the years. Make sure to note any modifications if you’ve changed jobs since 2020 or if there have been any significant changes in your financial situation.

New W-4 Form for 2020

In 2020, the IRS released a new version of the W-4 Form, aiming to simplify the process for employees to determine their tax withholding. The form underwent several changes, and it’s crucial to stay informed about the updates. By understanding the modifications, you can accurately complete the form and avoid any potential discrepancies or surprises when filing your taxes.

In 2020, the IRS released a new version of the W-4 Form, aiming to simplify the process for employees to determine their tax withholding. The form underwent several changes, and it’s crucial to stay informed about the updates. By understanding the modifications, you can accurately complete the form and avoid any potential discrepancies or surprises when filing your taxes.

W4 Form 2022

Looking ahead to the future, it’s essential to know that the W4 form for 2022 is available as well. Keeping up with yearly changes and ensuring you have the most up-to-date form is vital for accurate tax withholding. Remember to review and update your information each year to reflect any changes in your personal circumstances, such as marriage, having a child, or changes in income.

Looking ahead to the future, it’s essential to know that the W4 form for 2022 is available as well. Keeping up with yearly changes and ensuring you have the most up-to-date form is vital for accurate tax withholding. Remember to review and update your information each year to reflect any changes in your personal circumstances, such as marriage, having a child, or changes in income.

Form W4 2020.pdf

For those who prefer a digital format, you can find the Form W4 for the year 2020 in PDF format. This allows you to access and save the form easily on your computer or device. Keep in mind that it’s always a good idea to double-check if there have been any updates or changes to the form since 2020, as mentioned earlier.

For those who prefer a digital format, you can find the Form W4 for the year 2020 in PDF format. This allows you to access and save the form easily on your computer or device. Keep in mind that it’s always a good idea to double-check if there have been any updates or changes to the form since 2020, as mentioned earlier.

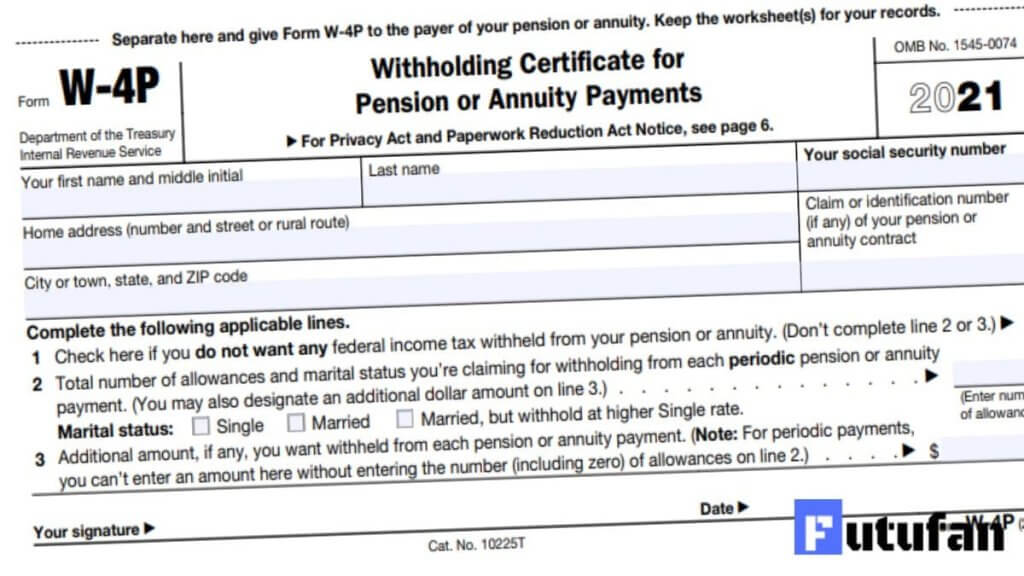

W4 Form 2020 - Futufan #Futufan #W-4Forms #Money #IRS #Finance #Tax #W4

If you’re looking for a visually appealing version of the W4 form from 2020, you’ll find this Futufan design quite interesting. While the layout and design may vary, it’s essential to ensure that the content and information you provide on the form are accurate, regardless of the form’s appearance.

If you’re looking for a visually appealing version of the W4 form from 2020, you’ll find this Futufan design quite interesting. While the layout and design may vary, it’s essential to ensure that the content and information you provide on the form are accurate, regardless of the form’s appearance.

IRS Form W4 2022 Printable

For your convenience, the IRS provides a printable version of the W4 form for the year 2022. Having a printable copy allows you to review and complete the form at your own pace. It’s crucial to take your time and provide accurate information to ensure that you won’t have any issues with your tax withholding in the coming year.

For your convenience, the IRS provides a printable version of the W4 form for the year 2022. Having a printable copy allows you to review and complete the form at your own pace. It’s crucial to take your time and provide accurate information to ensure that you won’t have any issues with your tax withholding in the coming year.

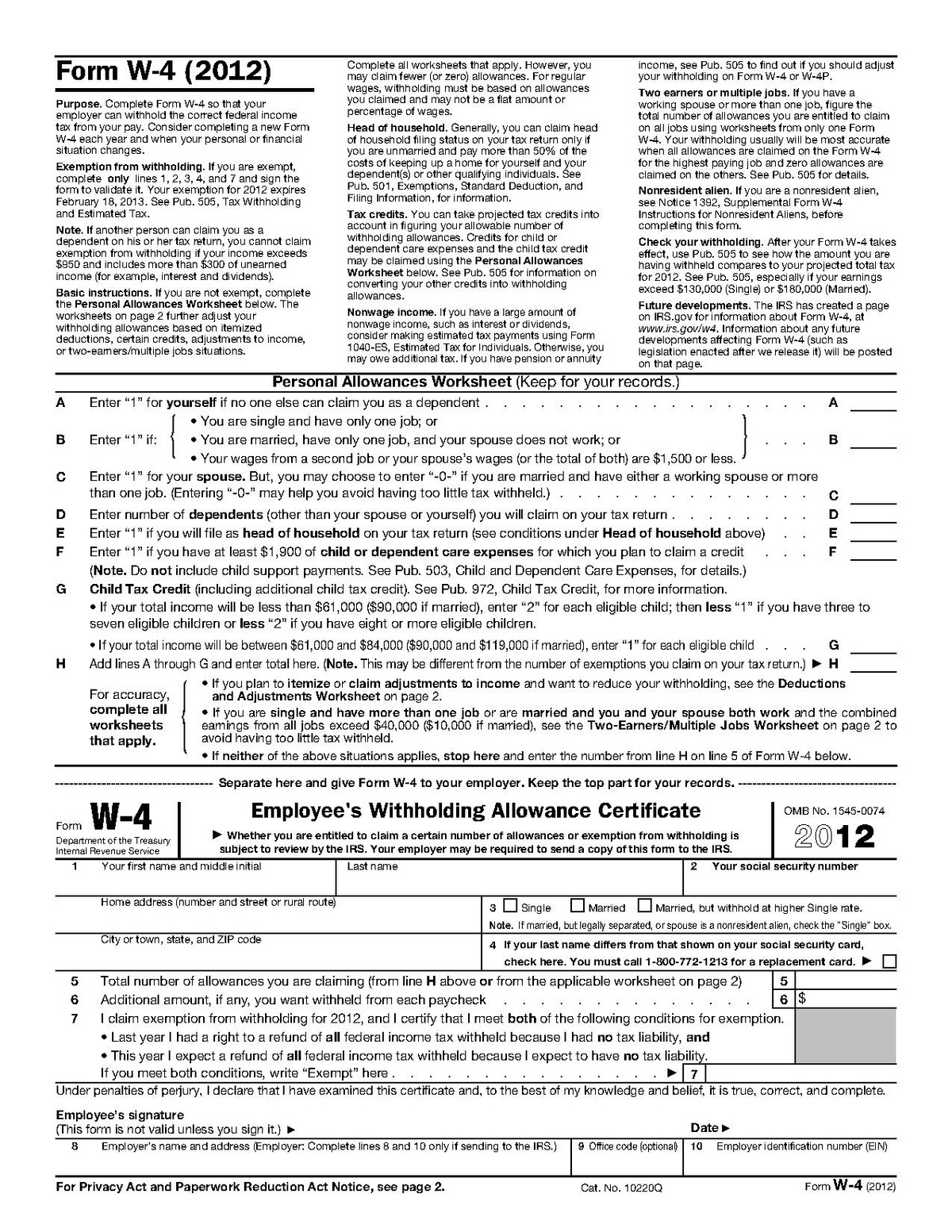

W4 Form 2020

Lastly, if you still need to refer to the W4 form from 2020, it’s essential to obtain the correct version. Revisiting the guidelines and instructions can help refresh your understanding of the form’s requirements. This is particularly important if you’ve experienced any changes in your financial situation or employment since 2020.

Lastly, if you still need to refer to the W4 form from 2020, it’s essential to obtain the correct version. Revisiting the guidelines and instructions can help refresh your understanding of the form’s requirements. This is particularly important if you’ve experienced any changes in your financial situation or employment since 2020.

What you should know about the new Form W-4

If you want to stay up to date with the most recent changes to the W-4 form, make sure to familiarize yourself with the new 2021 version. Understanding the updates will help ensure that you correctly complete the form and avoid any discrepancies with your tax withholding. Stay informed and be aware of any modifications made each year.

If you want to stay up to date with the most recent changes to the W-4 form, make sure to familiarize yourself with the new 2021 version. Understanding the updates will help ensure that you correctly complete the form and avoid any discrepancies with your tax withholding. Stay informed and be aware of any modifications made each year.

Remember, the W-4 form plays a vital role in accurately calculating your tax deductions. It’s crucial to provide accurate information, review the form annually, and seek professional advice if needed. By staying informed and taking the time to understand the requirements, you can ensure that your tax withholding aligns with your financial situation.