Being an independent contractor has its advantages and challenges. As tax season approaches, it’s important to understand the ins and outs of Form 1099, which is used to report income earned through self-employment. In this article, we will explore the details of Form 1099 and its significance for independent contractors.

Independent Contractor Tax Form 1099 - Form : Resume Examples #e79QggdMVk

Let’s begin with a comprehensive overview of Form 1099. This form is used by businesses to report payments made to independent contractors. As an independent contractor, you are responsible for reporting your income accurately and paying any applicable taxes. Form 1099 helps facilitate this process and ensures transparency in your finances.

Let’s begin with a comprehensive overview of Form 1099. This form is used by businesses to report payments made to independent contractors. As an independent contractor, you are responsible for reporting your income accurately and paying any applicable taxes. Form 1099 helps facilitate this process and ensures transparency in your finances.

Form 1099 – MISC - Due January 31, 2013

The Form 1099 – MISC is the most common type of 1099 form used to report miscellaneous income received by independent contractors. It includes various types of income, such as non-employee compensation, rent, royalties, and more. This form is due by January 31st of each year, so make sure you gather all the necessary information and file it on time.

1099 Form Independent Contractor Pdf / 14 Printable 1099 form

If you prefer working with digital forms, you can easily find a 1099 Form Independent Contractor PDF. These PDFs are printable, allowing you to fill them out electronically or by hand. It’s important to include accurate and detailed information when completing the form, as any discrepancies may lead to issues with the Internal Revenue Service (IRS).

1099 Form Independent Contractor Pdf : IRS 1099 Misc Form Free Download

For your convenience, the IRS provides a free download of the 1099 Form Independent Contractor PDF. This ensures that you have access to the official form and can easily complete it. By using the official IRS form, you can be confident that you are meeting all the necessary requirements and guidelines set forth by the government.

For your convenience, the IRS provides a free download of the 1099 Form Independent Contractor PDF. This ensures that you have access to the official form and can easily complete it. By using the official IRS form, you can be confident that you are meeting all the necessary requirements and guidelines set forth by the government.

Printable 1099 Form Independent Contractor Form : Resume Examples

To make the process even more convenient, you can find printable 1099 Form Independent Contractor templates online. These templates provide a pre-designed format that you can fill out with your information. They often come with helpful instructions and examples, making it easier for you to accurately report your income.

To make the process even more convenient, you can find printable 1099 Form Independent Contractor templates online. These templates provide a pre-designed format that you can fill out with your information. They often come with helpful instructions and examples, making it easier for you to accurately report your income.

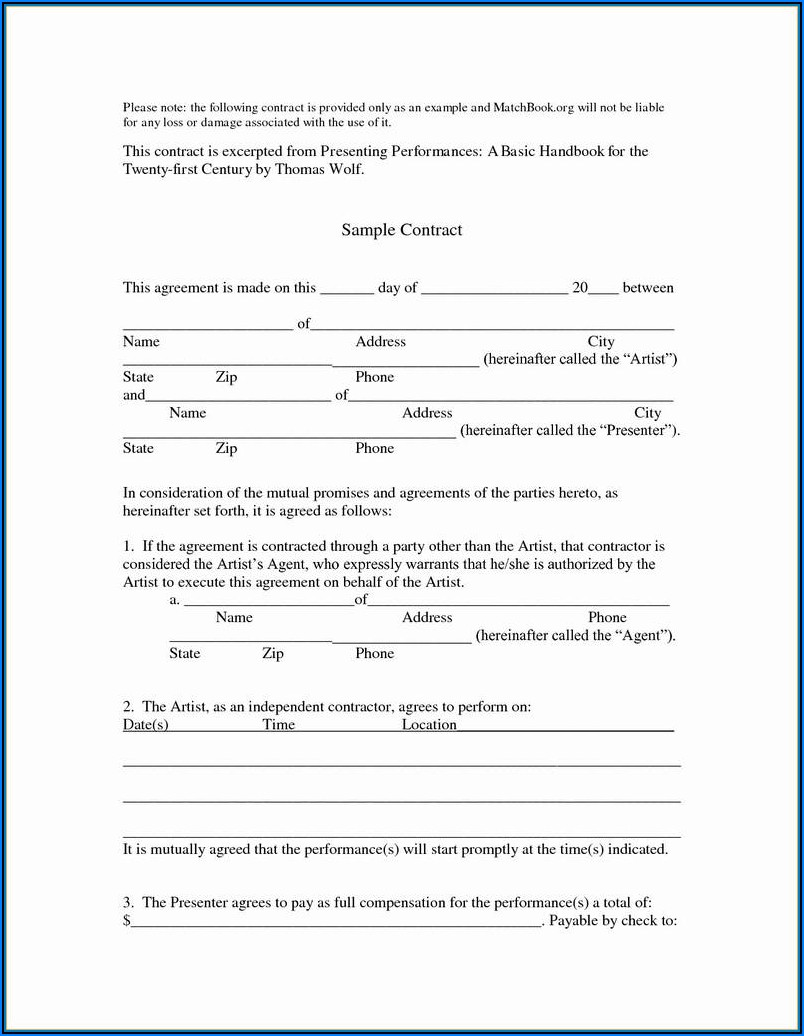

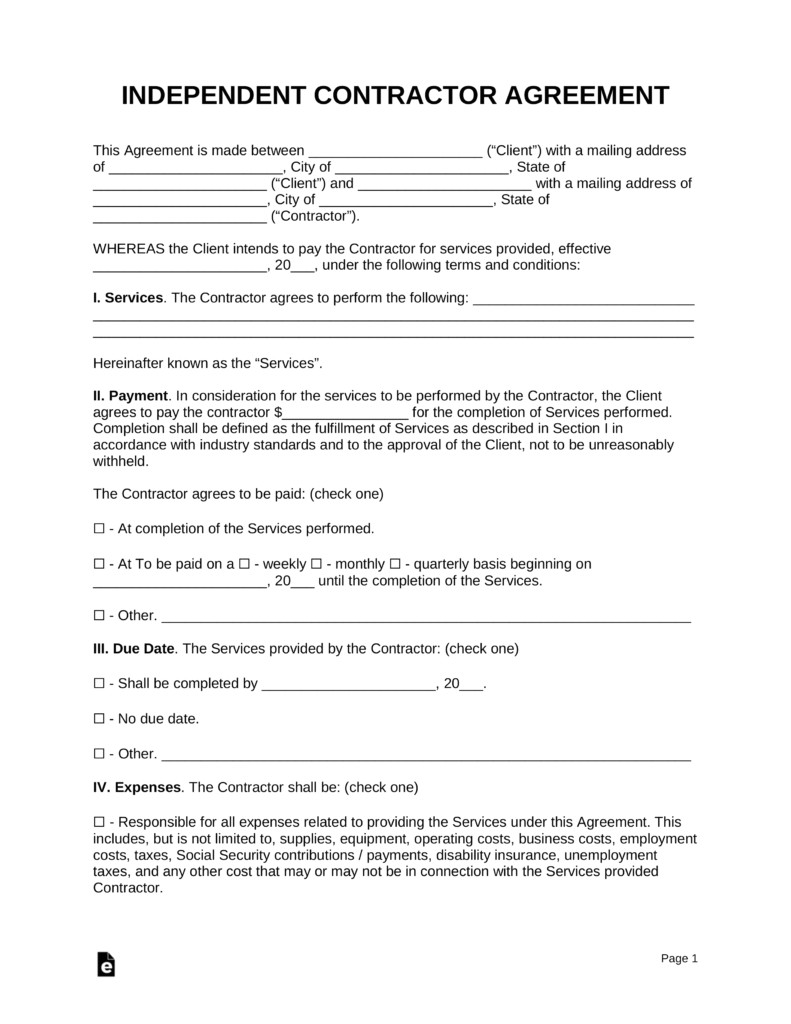

1099 Employee Contract Template | williamson-ga.us

In addition to tax forms, it’s essential to have proper contract agreements in place when working as an independent contractor. The 1099 Employee Contract Template can assist you in establishing an agreement with the companies you work for. By clearly outlining responsibilities, compensation terms, and project scope, you can protect your rights and ensure a mutually beneficial working relationship.

In addition to tax forms, it’s essential to have proper contract agreements in place when working as an independent contractor. The 1099 Employee Contract Template can assist you in establishing an agreement with the companies you work for. By clearly outlining responsibilities, compensation terms, and project scope, you can protect your rights and ensure a mutually beneficial working relationship.

1099 form independent contractor - Fill online, Printable, Fillable Blank

Are you looking for an easy way to complete the 1099 Form Independent Contractor? Consider filling it out online using a fillable blank template. By doing so, you can avoid the hassle of printing and handwriting the form. Instead, you can complete it electronically, saving time and effort.

Are you looking for an easy way to complete the 1099 Form Independent Contractor? Consider filling it out online using a fillable blank template. By doing so, you can avoid the hassle of printing and handwriting the form. Instead, you can complete it electronically, saving time and effort.

1099 Form Independent Contractor Pdf / Form 1099 is a type of

Form 1099 is a type of tax form used to report various types of income, including self-employment income earned by independent contractors. It is crucial to understand the different variations of Form 1099 and choose the appropriate one based on your specific situation. By using the correct form, you can accurately report your income and fulfill your tax obligations.

Free 1099 Forms For Independent Contractors | Universal Network

When it comes to tax season, it’s always helpful to have access to free resources. Universal Network offers free 1099 Forms for independent contractors. These forms are essential for reporting your income accurately and complying with IRS regulations. By utilizing free resources like these, you can save money and streamline the tax filing process.

When it comes to tax season, it’s always helpful to have access to free resources. Universal Network offers free 1099 Forms for independent contractors. These forms are essential for reporting your income accurately and complying with IRS regulations. By utilizing free resources like these, you can save money and streamline the tax filing process.

1099 Tax Form Independent Contractor | Universal Network

As an independent contractor, you are responsible for paying your taxes on income earned through self-employment. The 1099 Tax Form Independent Contractor helps you report this income accurately and fulfill your tax obligations. By providing all relevant information, you can ensure compliance with tax regulations and avoid penalties or issues with the IRS.

As an independent contractor, you are responsible for paying your taxes on income earned through self-employment. The 1099 Tax Form Independent Contractor helps you report this income accurately and fulfill your tax obligations. By providing all relevant information, you can ensure compliance with tax regulations and avoid penalties or issues with the IRS.

In conclusion, Form 1099 is a critical tool for independent contractors to report their income and fulfill their tax obligations. Whether you choose to use printable forms, digital PDFs, or online templates, it’s crucial to complete the form accurately and on time. By doing so, you can ensure transparency in your finances, protect your rights, and maintain a positive working relationship with your clients.