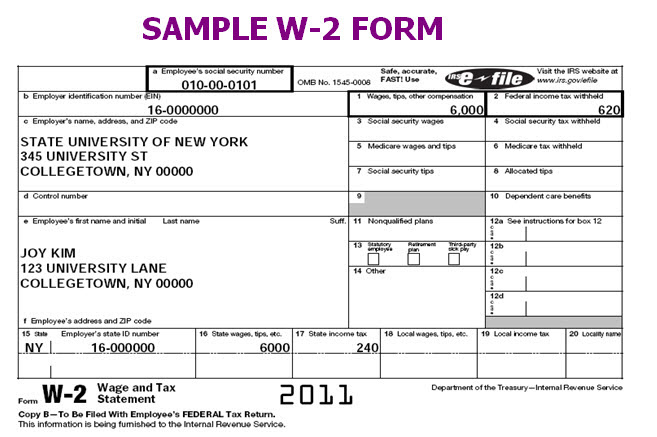

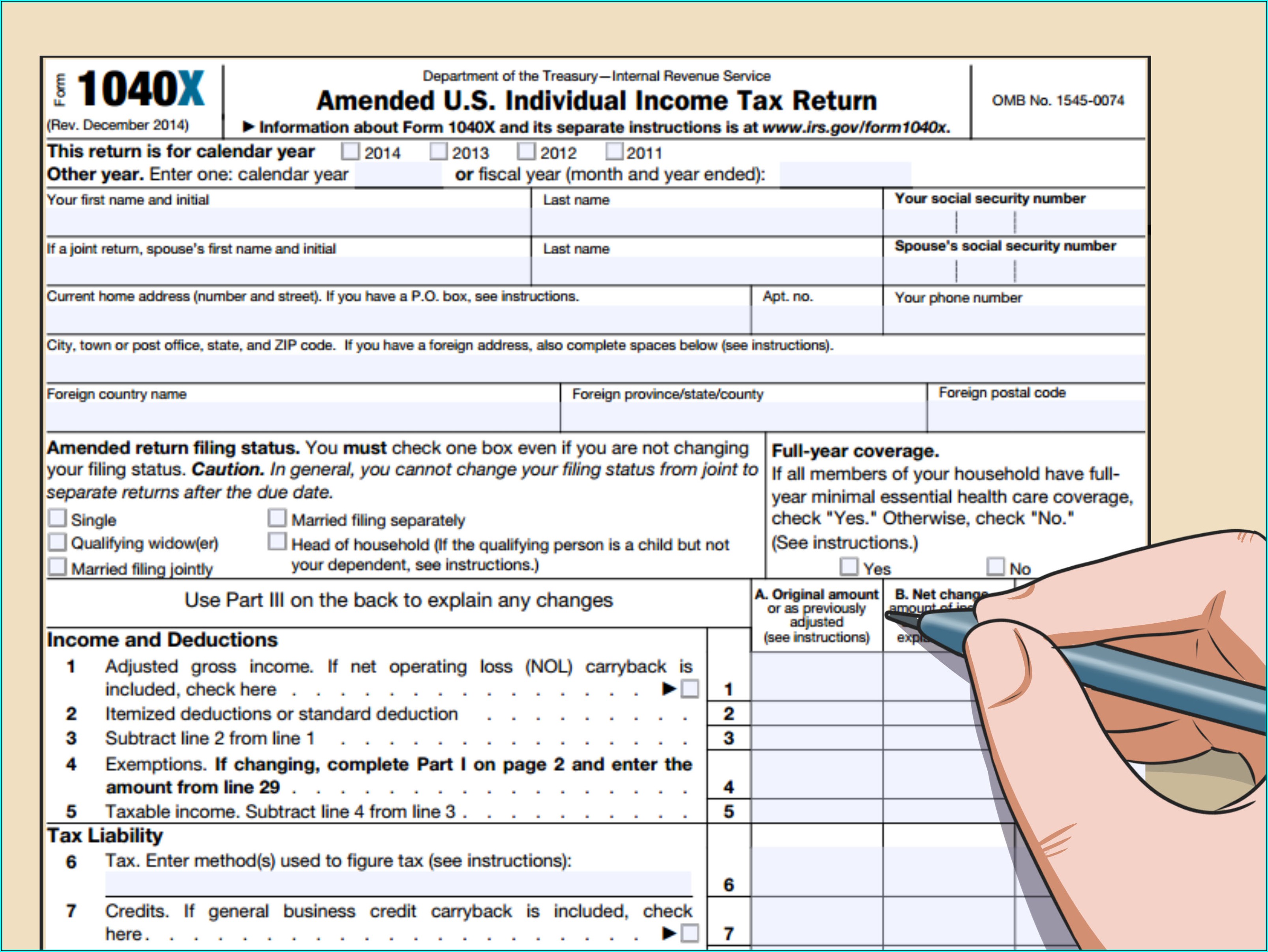

Can you believe it’s that time of year again? Yes, it’s tax season! I know, it may not be the most exciting topic, but it’s an important one. And one key document that you need to be familiar with is the W2 form. Whether you’re a student, an employee, or a business owner, understanding the W2 form is essential in managing your taxes. So, let’s dive into everything you need to know about the W2 form! First and foremost, what exactly is a W2 form? Well, it’s a tax form issued by employers to their employees. It provides a summary of the employee’s earnings, as well as the taxes withheld throughout the year. The form contains vital information, such as your Social Security number, wages, and the amount of taxes withheld. Now, you might be wondering why this form is so important. Well, the information on your W2 form is used to fill out your tax return, which determines whether you owe taxes or are eligible for a refund. It’s crucial to ensure that the information on your W2 form is accurate and matches your pay stubs. Otherwise, you could face discrepancies when filing your taxes. To give you a better idea of what a W2 form looks like, let’s take a look at a sample. Check out the image below:  As you can see, the form is divided into several sections. The top section includes your personal information, such as your name, address, and Social Security number. It’s important to double-check this information for accuracy. Moving down the form, you’ll find details about your wages, tips, and other compensation. This section includes information about your total earnings, as well as any deductions or pre-tax contributions you made throughout the year. Next, you’ll come across the federal income tax withheld section. This shows the amount of federal income tax that was withheld from your paycheck. It’s important to note that this amount is an estimate and may not match your final tax liability. The subsequent sections of the W2 form cover Social Security and Medicare taxes withheld, as well as any other state and local taxes. These amounts are used to calculate your total tax liability. To get a closer look at the different sections of a W2 form, check out the following image:  Now that you have a better understanding of what a W2 form entails, you might be wondering how to obtain one. Typically, you’ll receive your W2 form from your employer by the end of January. Make sure to keep an eye out for it in your mailbox or email. In some cases, you might need to request a W2 form from a former employer. If that’s the case, you can use a template like the one shown below:  Simply fill in your information and send it to your former employer. They should be able to provide you with the necessary documentation. As you gather all your W2 forms, it’s essential to keep them in a safe place. You’ll need them when filing your taxes or in case you’re ever audited by the IRS. Consider creating a file specifically for tax-related documents, so you can easily access them when needed. Now that you’re familiar with the W2 form, it’s time to start preparing your tax return. Be sure to consult with a tax professional or use reputable tax software to ensure accuracy. Remember, it’s always better to be proactive and seek assistance if you’re unsure about any aspect of your taxes. Understanding the W2 form is just one piece of the puzzle when it comes to managing your finances. By staying informed and organized, you can navigate the world of taxes with confidence. So, don’t stress too much about tax season. Take a deep breath, gather your documents, and let’s conquer those taxes together!